We have come across a lot of instances where insurance companies have dishonored claims without any proper reasoning. Just because it’s an easy option for them and they know that most of the users don’t have the means and time to file a case. We have come across a case wherein Acko Technology & Services […]

Came across a post on LinkedIn indicating that many Fintech companies aspire to be Tech Service Providers (TSPs) and are transitioning towards a B2B SaaS model. The reasons cited were:🔹 The Funding Winter🔹 Strict RBI Regulations Impacting the Fintechs🔹 Cut-throat competition impacting the volumes🔹 Lower/Irregular margins in the B2C model🔹 B2C becoming risky as bigger […]

Influencers play a significant role in B2C fintech marketing by leveraging their authority, credibility, and reach to promote fintech products and services to consumers. Here’s how influencers can help in B2C fintech marketing: Overall, influencers can be powerful allies for fintech companies looking to reach and engage with consumers in a meaningful way. By leveraging […]

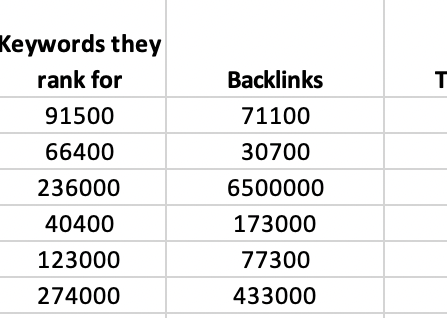

We come across a lot of B2C Fintech Brands in our day-to-day lives. Sometimes when B2C brands spends heavily on Television Ads, Outdoors, OTT platforms, Cricket especially World Cup and IPL sponsorships, Digital Marketing viz Google Search Ads, Display Ads, Youtube Ads, Facebook and Instagram Ads, LinkedIn Ads, Twitter Ads, Tiktok Ads or let’s say […]

#FintechOnDemand and #OnDemandFintech through the lenses of B2B Marketing “Fintech On Demand” refers to the growing trend of financial technology (fintech) services being readily available and accessible to consumers and businesses whenever they need them. This concept encompasses various fintech solutions and platforms that offer on-demand financial services, often leveraging digital technology and automation to provide convenience, […]

A Virtual Private Network (VPN) is a technology that creates a secure, encrypted connection over the internet between a user’s device and a remote server. This connection hides the user’s IP address and encrypts data transmitted between the device and the server, enhancing privacy and security. Detailed Analysis of VPN: Application of VPNs in Fintechs […]

We will keep updating the current status of Paytm after RBI had taken action against it due to lack of Compliance. Paytm QR to work beyond March 15. Paytm shifted its nodal account to AXIS Bank by creating an escrow account Paytm QR, Soundbox, Card machine will continue to work as always beyond March 15, […]

Open banking refers to a financial concept and practice that allows third-party financial service providers to access and use financial data from banks and other financial institutions through Application Programming Interfaces (APIs). This data sharing enables these third-party providers to develop new financial products and services, often tailored to meet specific consumer needs. Key aspects […]

Click here for FIXED DEPOSIT CALCULATOR 1. Introduction: The Deposit Insurance and Credit Guarantee Corporation (DICGC) is a subsidiary of the Reserve Bank of India (RBI) and serves as the primary entity responsible for providing deposit insurance to depositors in Indian banks. Established in 1978, DICGC plays a crucial role in safeguarding the interests of […]

According to RBI, your deposit is secured upto Rs 5 Lakhs by Deposit Insurance and Credit Guarantee Corporation (DICGC) A Fixed Deposit (FD) calculator is a tool that helps individuals estimate the interest earned and the maturity amount for a fixed deposit investment. The formula for calculating interest on fixed deposits is straightforward, but a […]